Is AI the Biggest Game Changer or Are We in a Bubble? Yes

AI infrastructure accounted for the vast majority of US GDP growth in the last quarter. The NASDAQ is at all-time highs driven by AI-fueled stocks, many exceeding trillion-dollar valuations. Private companies are raising giant rounds at eye-popping valuations on the flimsiest of business plans and performance.

As the excitement around AI accelerates, the inevitable “are we in a bubble or is this time different?" is up for debate. Our answer is simple: AI is completely transformative, and yet the path isn't so different vis-a-vis previous revolutions.

The GPU “Real” Demand vs. Dark Fiber Fallacy

Many argue this isn't like the dark fiber of the dot-com era because GPU demand is demonstrably real. Hyper-scalers (who generate massive cash flows in their core businesses thus have real cash to pay for their investments) are spending tens of billions on infrastructure. Inference costs are plummeting while usage skyrockets. The compute is being utilized, not sitting idle in the ground.

But this misunderstands what burst the Internet bubble.

The fiber itself had real demand - companies genuinely needed bandwidth. What collapsed wasn't the infrastructure thesis; it was the monetization timeline. The ultimate demand for that fiber was driven by profitable usage, and it took far longer to convert "eyeballs" and “page views” to revenue than anyone expected. When the gap between infrastructure spend and monetizable demand became undeniable, the bubble burst.

Sound familiar? Today, the GPUs and datacenter buildouts are the fiber, and the unprofitable AI revenue is the eyeballs. AI usage and revenues are exploding, but revenues with negative gross margins are always easy to make explosive. This may not end badly – so long as margins advance faster than markets tire of subsidizing losses against future profits and market share - but the pattern is similar to the past. There are certainly mitigating factors, most notably faster adoption and better capitalized buyers. But while history doesn’t repeat itself, it does rhyme.

Transformation is Real, But Slower Than Markets Price

The world changed completely with the internet. The internet enabled the rise of the cloud, social, and mobility. Our economy, our biggest companies, and our society have been forever altered. Had someone in 1999 been able to peek into 2025, they would have correctly concluded that they should invest heavily in the platform shift. But consider this: 25 years later, only 16% of US retail is e-commerce.

Think about that. A quarter-century after the internet changed everything, more than 80% of retail transactions still happen in physical stores. ATM locations in the US have doubled since the dot-com era. 75% of books sold today are still physical.

This tells you that behavior and purchase patterns take far longer to change than anyone assumes, even for genuinely transformative technologies. Even if AI penetrates faster than any technology in history, the odds of the market running ahead of reality as we all figure out how AI will change businesses and how to cost-effectively incorporate it into our lives are extraordinarily high.

While many of us use it frequently, no one is yet anywhere close to paying for the fully-loaded cost nor value delivered. Businesses are nowhere near paying the costs of an actual worker, and implementation, security, compliance, and quality control issues will need to be sorted out before adoption can ramp up exponentially. In the consumer space, few of the kids doing homework or individuals asking for recipes or funny videos or travel advice would be using it so intensely if they had to pay the true fully-loaded cost of their query (especially because ad-supported models will have to be rethought from the ground up as its not fully clear today how to charge for a full immediate answer bypassing all page views).

Furthermore, our view as to who would emerge dominant in the very early days of the Internet era was hazy at best. The excitement that is a feature of the US economy led to copious amounts of capital allocated to tenuous business models, many copycat approaches, and businesses with very thin layers of defensibility (a startup that enabled the comparison of cellphone plans comes to mind - it raised tens of millions from a blue chip VC in the late stages of the bubble).

What History Teaches Us: Stay in the Game

However, here's where it gets interesting: unless you can time the market perfectly (you can't), history teaches us that you should stay in tech markets consistently to yield great returns.

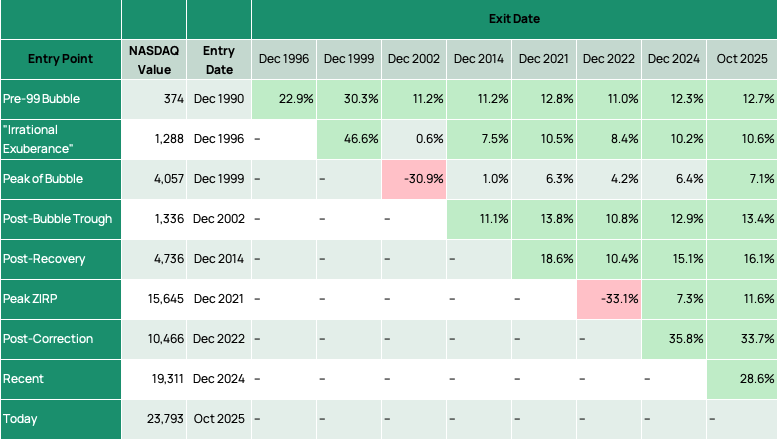

Consider the data. We analyzed NASDAQ returns across various entry and exit points (using S&P or private markets data yields similar results, more attenuated with the former and more pronounced with the latter) from the pre-bubble 1990s through the dot-com crash, the ZIRP era, and into today's market:

.

IRR Investing in NASDAQ at Various Entry and Exit Dates

The data is unequivocal: unless you plow your money only at the absolute peak and withdraw soon thereafter, you will be better off. And incredibly better off being consistently in the market - don’t under- nor over-invest when it feels “bubbly” – that is the secret to success.

Yes, if you put all your money to work at the top of the market, it will take a very long time to get back to acceptable returns. Those who invested at the peak in December 1999 saw negative returns for years and ultimately achieved only modest single-digit IRRs even over two decades.

But if you leave too early to “avoid the correction”, you also miss the rising tides, and you will never compound effectively: if you divested from the NASDAQ when Alan Greenspan called "irrational exuberance" in December 1996, you would have missed out on a 46.6% annualized run-up to the top. Net of the subsequent correction, you would have been worse off by only a few years compared to those who stayed invested - and if you spent most of the time out of the market in "safer" instruments, you could never catch up.

The math is brutal and incontrovertible. Even those who invested at the absolute peak of the dot-com bubble in 1999 and held through the crash eventually recovered to 7.1% annualized returns by today. Those who invested at the post-bubble trough in 2002 captured 13.4% annualized returns. And those who had the courage to buy into the post-ZIRP correction in 2022 have already generated 33.7% annualized returns.

The lesson: unless you have a crystal ball, timing the exact top is nearly impossible, and leaving too early means potentially missing the substantial run-up that precedes a correction. If you believe in the inexorable progress of capitalism and technology, past results show you should stay invested.

Of course, no one is here to do “just OK”. Savvy investors want to lean in after corrections and be cautious during upswings. And if you are picking specific stocks or companies, resist the herd mentality and look for the jewels: “N of 1” founders with compelling business models that have durable moats.

This post is about #2: ground source heat pumps, or GHPs/GHSPs. These systems circulate water through loops buried a few hundred feet underground, then use a heat pump to exchange that temperature with the building above. In winter, it pulls heat in. In summer, it pushes heat out. It’s like giving your building a direct line to use the Earth as a battery.

Because the ground is always temperate, the system doesn’t have to work as hard. The result: huge efficiency gains. A typical geothermal heat pump has a coefficient of performance (COP) of 4 - which means you get 4 units of heating/cooling for every 1 unit of electricity used.

In plain terms: it's 3–5x more efficient than gas or conventional A/C. And it works anywhere, 24/7, all year.

Navigating Bubbly Times: Our Approach at Avila

For those of us investing in early-stage private markets, the biggest platform shift in history affords more opportunity than ever. We have the unenviable challenge of making decisions in the fog of war, but the extraordinary opportunity to discern and select unique opportunities with a long-term lens. Platform shifts are the best entry points for startups. We are not market-timing public securities; we're backing founders for decade-long journeys. Our focus at Avila is on separating the seemingly obvious near-term bets at rich valuations but with less discernible moats from the patient plays into the long arc of platform shift value creation.

The obvious bets are crowded. Every AI wrapper company. Every "ChatGPT for X" pitch. Every get rich quick app layer tool. Every app with explosive growth but no path to profitability. Every business that the foundation model builders can (and will) easily overtake to justify the billions spent on pre-training. Every robotic approach that will be commoditized before the current fund is even fully deployed. These may work - some will - but the risk-reward at current valuations is asymmetric in the wrong direction.

Our patient playbook looks different. We are backing founders solving problems that will matter in 2035, not just 2026. They’re building moats that compound - proprietary data flywheels, vertical or physical integration that can’t be disintermediated, technical innovations that create genuine barriers to entry. We pivoted towards the foundational layers of our economy a decade ago, and are now doubling down as technological progress and national strategic priorities provide trillion-dollar tailwinds to our thesis.

For us, this means:

Decade-scale vision: We back founders who understand that long-term moats typically take years to materialize, rather than businesses based on thin-layered, zeitgeist ideas that can be executed quickly and raise at lofty valuations due to an investor frenzy but are unlikely to withstand the test of time. OpenAI succeeded because they spent years building before the ChatGPT moment, and the foundations of abundance and industrialization will similarly take time to thrive.

Physical world integration: Pure software plays are elegant, but they’re also vulnerable. The marginal cost of software is approaching zero, which means so does sustainable differentiation in the absence of network effects or proprietary data. We’re drawn to companies that combine bits and atoms where the physics of the real world or the value of scale and experience creates natural moats.

True technical moats: For pure software plays, we insist on genuine technical differentiation. Not “we use AI better” or “we have world-class agents” but “we have proprietary data/models/techniques that create compounding advantages.” The kind of moat that deepens over time with scale and strong execution.

Both/And, Not Either/Or

So: is AI the biggest gamechanger or are we in a bubble? Yes.

AI will transform everything. The question isn't whether transformation is coming - it's already here. The question is how long it takes, who captures the value, and what happens to valuations in the meantime.

The companies being built today will create trillions of dollars in value. But not all of them. Not even most of them. And the path from here to there will be volatile, unpredictable, and far longer than today's pitch decks suggest. One more risk: this time the incumbents seem much more poised to succeed, having learned the lessons of the past.

For investors, the answer isn't to flee the market or to bet everything on the big, sexy plays. It's to stay invested without over investing, stay selective, and stay focused on the fundamentals that have always mattered: durable moats, capital efficiency, and founders with the vision and grit to build for a decade, not a quarter.

At Avila, we understand the bubble and transformation co-exist and are here to back the teams building for a long-term future of energy abundance, renewed industries and a thriving environment.